APCIA says auto insurance has an ‘uncertain road ahead’ as claims outpace premium increases

By onInsurance

According to a whitepaper by the American Property Casualty Insurance Association (APCIA), auto insurance claims inflation has continued to rise faster than the underlying consumer price index (CPI), and claims are far outpacing premium increases.

In its paper, called “Auto Insurance: The Uncertain Road Ahead,” APCIA writes that the combination of rapidly increasing overall economic inflation and claims inflation has driven up auto insurance losses and combined ratios.

“In addition to inflation trends, the private passenger auto insurance sector is also experiencing several other trends such as increased frequency and severity of claims cost, riskier driving behavior by the public, cost increases for medical and hospital services, and outsized growth in lawsuit verdicts and legal system abuses, that are negatively impacting and pressuring the industry with increased losses,” said Robert Passmore, APCIA personal lines department vice president and co-author of the paper.

Last June, in a similar report, APCIA also said inflation and alleged legal system abuse as well as the COVID-19 pandemic, natural disasters, and cybercrime caused the cost of claims to go up.

The report, “Commercial Insurance Rates Rising: What Business Owners Need to Know,” states that the cost of claims paid out was more expensive over the last year when compared to 2020 due to inflation and “other developments,” which made loss adjustment expenses increase 17.8% in Q3 2021 compared to Q3 2020.

APCIA found that losses on underwriting in 2022 for private U.S. P&C insurers were $25.6 billion — more than double the losses in 2021 and the worst result since 2011, according to the latest report.

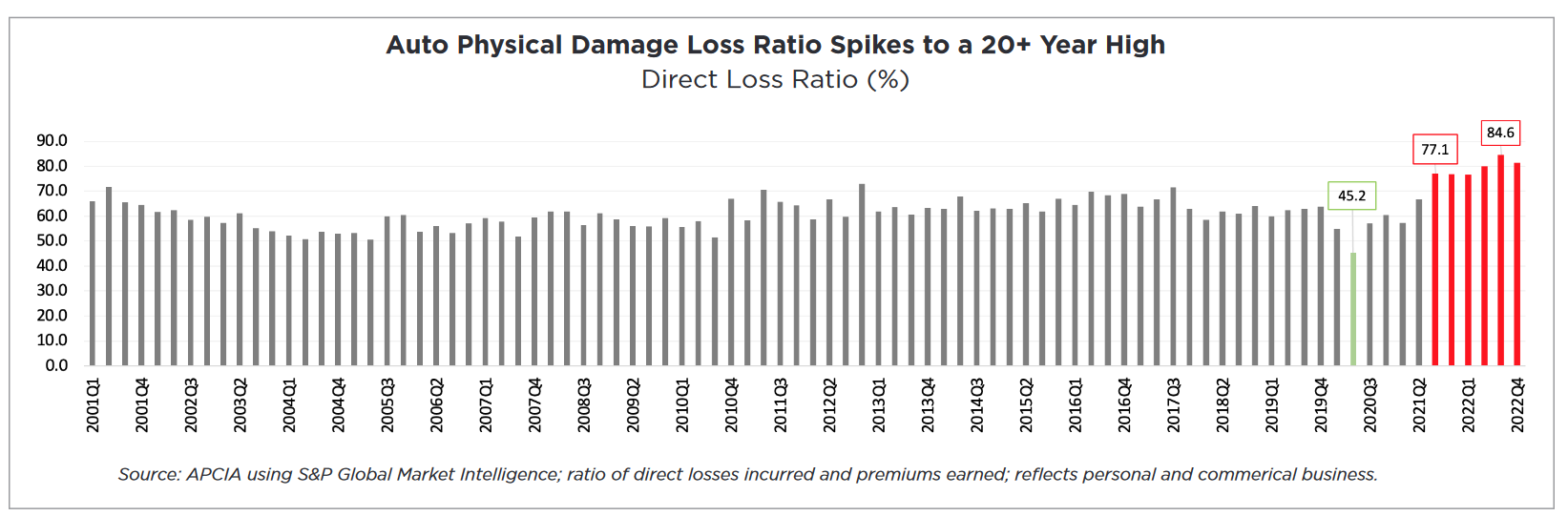

Private passenger auto insurance experienced the highest direct loss ratio among major lines of business at 80.2%, excluding loss adjustment expenses, last year. That equates to an increase of 12.2 points from 2021 and 24.1 points over 2020.

Lexis Nexis reported in a white paper earlier this year that total loss ratios worsened during the first nine months of 2022, with 27% of collision claims deemed total losses.

Also, bodily injury and property damage severity increased 35% since 2019, while collision severity spiked by about 40% during the same period.

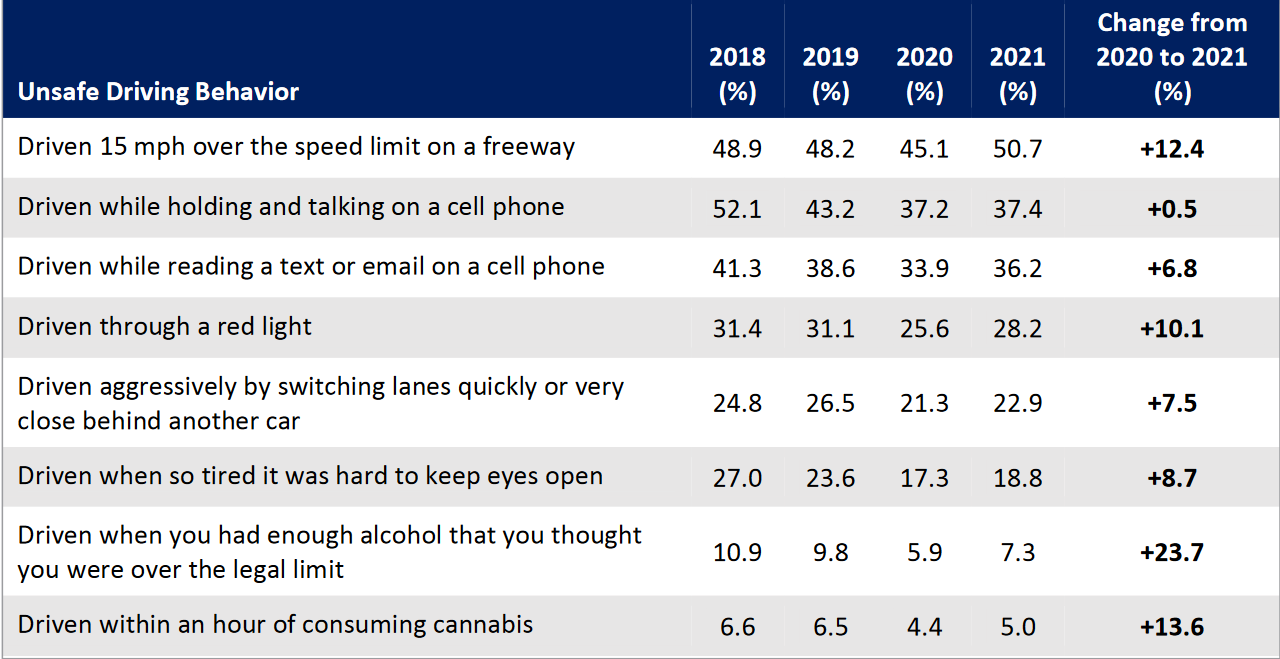

APCIA noted that part of the increase in claims severity is due to increases in risky driving behaviors, according to recent AAA data:

The report notes that broader economic issues factored into 2022’s severity dynamics, including auto parts, equipment, and body work which increased 10% year-over-year. During the same period, repair costs rose by 19% and hospital and healthcare-related services increased by 4.6%, it said.

U.S. private passenger vehicle damage claim severity—the average cost per claim for property damage liability and collision— increased by nearly 50% from 2018 to 2022, according to APCIA. Claims severity was impacted by rising auto repair and labor costs, inflation, and theft rates, APCIA said.

During the same period, average bodily injury claim severity increased 40%, reflecting an acceleration in medical inflation, legal system abuse, and a sharp increase in deadly motor vehicle accidents, according to APCIA.

P&C insurers’ premiums for personal auto increased 6% for the year compared to the 24% rate of escalating losses.

The Motor Vehicle Insurance CPI compiled by the U.S. Bureau of Labor Statistics includes a basket of goods and services auto insurers require to settle claims, and the June figure was up 6% year-over-year, accelerating from May’s 4.5% increase. It was the sixth-straight monthly increase.

“All indicators suggest elevated auto repair and replacement costs will stretch well into 2023 and potentially beyond,” Passmore said. “Medical inflation is also accelerating. Although insurers continue to monitor the situation closely, as claim costs continue to rise, insurers may be forced to pass these loss costs along to policyholders. Given the trends, insurers are strongly encouraging drivers to minimize their risk by avoiding risky driving behaviors that may result in a loss. Insurers are also advocating for better infrastructure, including reliable supply chains for critical auto parts and safer roads, which should result in fewer accidents and lower claims costs that help keep insurance premiums affordable for consumers.”

Shared several times by our readers, a New York Times article earlier this month reported that the average cost of repairs has soared 36% since 2018 and could top $5,000 by the end of this year, according to Mitchell International. And increased repair costs mean increased insurance premiums too, which according to the article, increased 17% between May 2022 and May 2023.

According to a recent S&P Global Market Intelligence analysis, premiums rose $7.4 billion during Q1 2023 to reach $76.3 billion, compared to the $68.83 billion of premiums written during Q1 2022.

See more of our coverage on increased repair costs here.

Images

Featured image credit: Aslan Alphan/iStock

More information

CIC: Possible solutions for shops to consider when tackling costs from inflationary pressures