J.D. Power: Repair process ‘doing pretty well’ for auto insurer satisfaction; avoid delays, lack of updates

By onBusiness Practices | Education | Insurance | Market Trends | Repair Operations

Property and casualty lead David Pieffer said Thursday the collision repair process was “doing pretty well” in terms of overall satisfaction reported by nearly 11,000 auto insurance policyholders in J.D Power’s annual survey.

He said he thought this could be attributed to carriers and body shops negotiating repair costs themselves, with the customer less involved.

However, unnecessary delays during the repair creates a “big drop” in overall customer satisfaction, Pieffer said. He said such delays were reported by about 25 percent of customers surveyed.

He said this might be a vehicle not ready when promised, or “waiting for approval” from an insurer on an estimate, repair or settlement.

Even if the delay isn’t the carrier’s fault, the insurer is blamed, according to Pieffer.

The results are important for both shops and carriers to keep in mind. Poor planning and blueprinting by a shop can blow one’s delivery date deadline, and carriers delaying with quibbles over legitimate repair costs might save a few hundred but drive away a customer worth $1,009.38 (if all three auto coverages are purchased) a year in premiums — and potentially thousands more in revenue before their next collision occurs.

J.D. Power’s research and our interview with Pieffer suggested another important factor for shops and insurers to heed.

J.D. Power reported that 65 percent of customers surveyed for the 2018 report received a digital status update from the insurer, and more than half of those were coupled with “offline status updates” by the carrier. CCC has found that keeping customers informed is a more important CSI factor than cycle time, and J.D. Power in 2017 reported a 33-point customer satisfaction score gain related to that variable.

“We absolutely agree with that,” Pieffer said when we referenced the CCC findings. He said he’s found some carriers with longer cycle times but who set expectations and keep the customer informed still do well with customers.

It “truly negates the need for speed,” he said.

Collision repairers will want to take this advice to heart as well and ensure they have an update process — and probably ideally one that informs the customer on their platform of choice. (Phone calls, text messages, email, etc.)

Comparing J.D. Power’s 2017 and 2018 stats shows a dramatic spike in customers receiving a digital status update — from 16 percent of customers reporting one during the November 2016 to August 2017 polling to 65 percent during the same period in 2017-18.

Pieffer said younger customers were more likely to support photo estimating or digital updates in 2017. However, in 2018, J.D. Power saw “significant improvement” in all four of its four age group categories with respect to digital status updates, according to Pieffer.

More information:

J.D. Power, Oct. 25, 2018

Images:

Keep your customer informed; it can matter more than cycle time does, according to CCC and J.D. Power. (tommaso79/iStock)

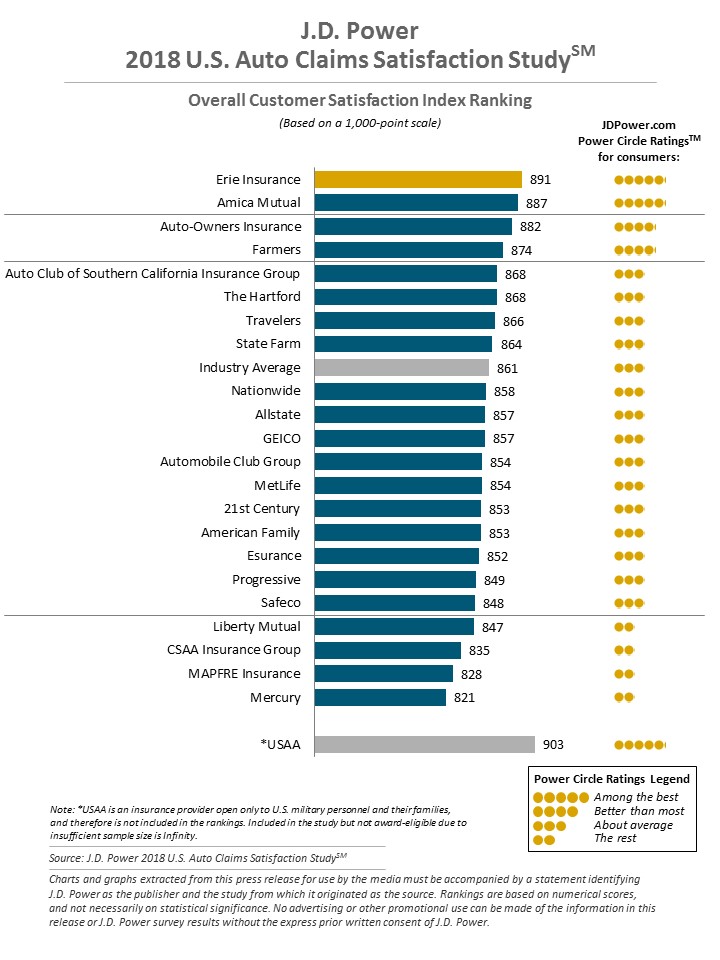

J.D. Power’s annual auto claims satisfaction study found in 2017-18 polling that satisfaction rose to 861 points out of 1,000, a record. (blocberry/iStock)