Auto-Owners: Honor OEM position statements on scans; estimates to start at 2 hours mechanical

By onAnnouncements | Business Practices | Insurance | Market Trends | Repair Operations | Technology

Auto-Owners has advised insurance adjusters that diagnostic checks are “integral” and might be needed even if an OEM doesn’t have a position statement.

“Auto-Owners Insurance Company believes pre and post scans are integral operations needed to bring an automobile to its pre loss condition,” the document from APD and estimatics manager Patrick Dowling states.

A copy of the “Pre and Post Scan Position Statement” was obtained by Collision Hub and posted Wednesday on Facebook.

Dowling said the insurer “will honor the vehicle manufacturers who have position statements regarding pre and post scans” and called the official OEM repair procedure portal OEM1Stop a “great resource” for position statements.

But the carrier was also open to scanning cars made by companies without formal position statements. (Volkswagen, for example, has said it didn’t issue a scanning position for the “fundamental reason” that directions to scan already exist within repair procedures — and have for “quite some time.”)

“Regardless of whether an OEM has a position statement or not, if an automobile with on board diagnostics is involved in a collision that requires an intrusion to the electrical, safety and / or driver assist systems and you are confident the operations will be performed, Auto-Owners will include pre and post scan operations on the initial appraisal,” Dowling wrote.

It’s becoming less likely that a vehicle involved in a collision didn’t suffer electronics damage, he wrote.

“Many of the manufacturers indicate that a vehicle with ‘any’ collision damage must be pre scanned and post scanned,” Dowling wrote. “Auto-Owners realizes there are instances where minor collision damage occurs with no intrusion to the electrical, safety and driver assist systems. This will be less common on newer vehicles.”

Auto-Owners’ default position will be to pay “1 hour for the pre scan and 1 hour for the post scan at the shop’s mechanical rate,” according to Dowling. But he also suggested Auto-Owners wouldn’t treat the 2.0-mechanical position as set in stone.

“If you are presented with an invoice documenting a higher charge, reimbursement through the supplement process is appropriate,” he wrote. He also noted that none of the estimating services have come up with an official scanning time.

The average mechanical labor rate found on CCC estimates last year was $87.17 an hour. Doubling that amount would work out to $174.34.

CCC in its “2019 Crash Course” reported an average scanning fee and/or labor charge of $150 in 2016, dropping to $70 for the fourth quarter of 2018. (CCC treated each scanning-related line item and cost as separate when calculating the average, so conceivably a typical estimate could mean a $70 pre-scan and a $70 post-scan for a total bill of $140.)

AirPro’s MSRP for a pre-repair scan on a vehicle with codes averages $89.95-$119.95, while its post-repair scan averages $119.95-$129.95. AsTech charges $119.95 for the first scan on a vehicle, be it pre, post, or diagnostic, and $50 per additional scan. There’s also the question of the additional labor required on the shop’s end to make a remote scan possible., not to mention markup on the sublet bill.

Dowling said adjusters still uncertain about a particular repair could “address the procedures in the form of a supplement after communication between vou and the shop.” However, he also didn’t dissuade the adjuster from using their own judgment to conclude a scan was appropriate on a vehicle with minimal damage and sticking the operation on the first estimate.

“In these instances (minor collision damage), communication with the collision repair facility on whether they are going to perform a pre and post scan is needed,” he wrote. “If you and the collision repair facility feel the pre and post scans are warranted, you may write for them up front or agree to write for the procedures in a supplement after receiving the actual scan report.”

Auto-Owners well-regarded by repairers, consumers

The Auto-Owners’ document seems to validate the rave reviews consumers and collision repairers have given the carrier.

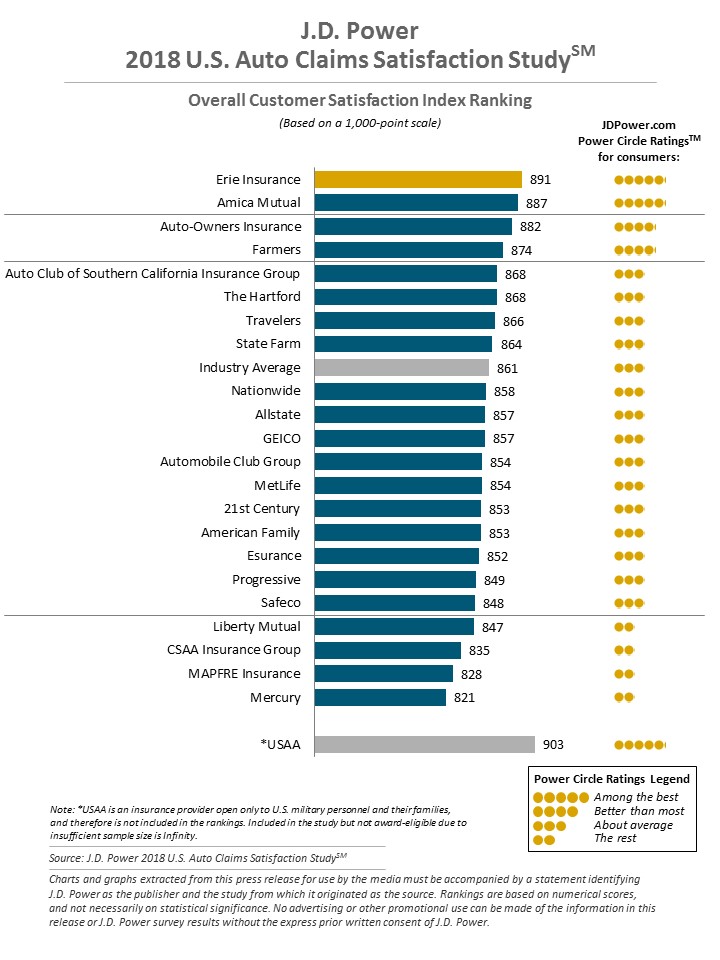

J.D. Power in 2018 reported the carrier ranked third in auto claims satisfaction, within less than 10 points of Nos. 1-2 Erie and Amica. Nearly 11,000 policyholders were studied.

CRASH Network’s 2017 survey of more than 1,200 collision repairers found Auto-Owners ranked 15th among insurers regarding the question “How well does this insurer’s claims handling policies, attitude and payment practices ensure quality repairs and customer service for motorists?” The carrier received a B nationally, and it was No. 1 in its home state of Michigan with an A-.

J.D. Power property and casualty lead David Pieffer in 2018 said unnecessary delays during the repair creates a “big drop” in overall customer satisfaction, Pieffer said. He said such delays were reported by about 25 percent of customers surveyed.

Given such findings, Auto-Owners’ plan to accept the reality of modern vehicles rather than resist it might help it preserve a CSI lead over more intransigent carriers.

State Farm scan document

The Auto-Owners position joins a similar document issued by State Farm. Together, the records ought to help body shops convince skeptical consumers or insurers of the validity of scanning.

In a memo to Select Service shops also shared by Collision Hub this year, State Farm told the direct repair program facilities to use their judgment on scans and to “prepare estimates in accordance with these specific repair procedures” from automakers regarding scans.

“Select Service repairers are responsible for determining when a pre or post scan is necessary to properly repair a vehicle,” State Farm wrote. “Requests for payment for vehicle scans should be based on case by case consideration, evaluating specific facts, vehicle equipment and damages specific to a particular loss.”

The insurer said it expects its Select Service shops to own a scan tool and “typically” only need 0.5 hours of mechanical time pre- and post-repair to do the work.

In case you were curious, State Farm ranked No. 8 in the J.D. Power study, and its CSI score beat the industry average. It placed 47th in CRASH Network’s 2017 Report Card with a B-.

Images:

The Auto-Owners Insurance logo. (Provided by Auto-Owners Insurance via PR Newswire)

J.D. Power’s annual auto claims satisfaction study found in 2017-18 polling that satisfaction rose to 861 points out of 1,000, a record. (Provided by J.D. Power)