Progressive big gainer as NAIC releases 2019 auto insurance market share data

By onAnnouncements | Associations | Business Practices | Education | Insurance | Market Trends

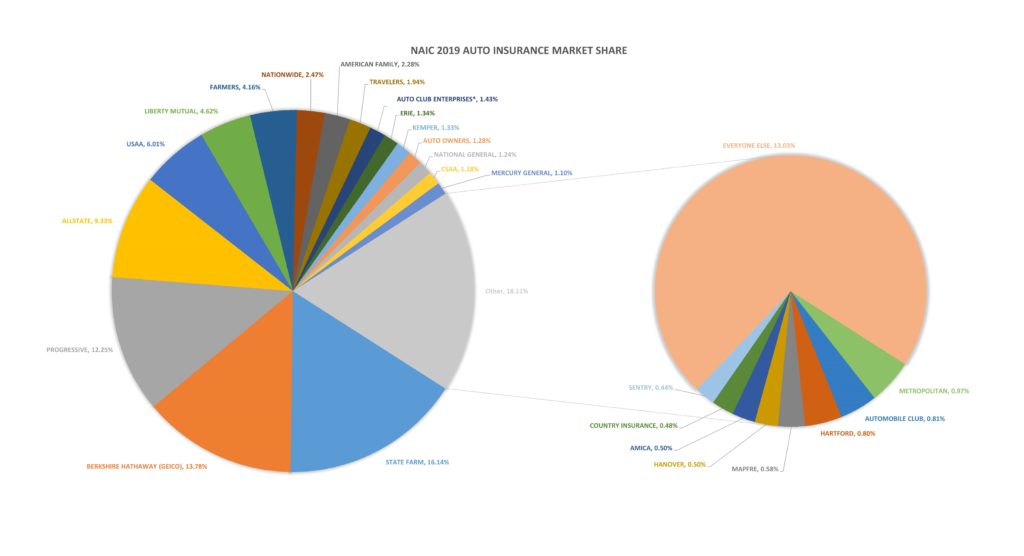

Progressive proved the champion of the auto insurance industry’s 2019 fight for customers, gaining more than a percentage point of market share last year.

The company remains the nation’s No. 3 auto insurer, according to March 30 National Association of Insurance Commissioners data. However, it rose 1.26 percentage points to now control 12.25 percent of the market.

The latest round of data — the NAIC estimates it covers about 98.77 of all P&C filings — also found GEICO and American Family making strides. No. 2 GEICO rose 0.34 percentage points to serve 13.78 percent of the market. American Family rose 0.38 percentage points to 2.28 percent and moved up from No. 10 to No. 9.

State Farm saw the biggest decline, falling 0.91 percentage points to 16.14 percent share. However, it remains the nation’s No. 1 auto insurer. No. 8 Nationwide also fell by more than 0.25 points, reaching a 2.47 share.

The industry also continued to consolidate, with the Top 10 insurers representing 71.04 percent of the market, up 0.61 percentage points from 2018. The Top 25 carriers rose 1.15 percentage points to control 86.97 percent of all private passenger auto premiums.

Other details potentially of interest:

- Auto-Owners climbed from No. 16 to No. 14 with 1.28 percent share, up 0.08 points.

- Allstate and USAA remained No. 4 and 5, respectively, but took 0.12 and 0.13 percentage points more of the market than they held in 2019.

- Insurers spent more of customers premiums on losses in 2019: 64.61 cents for every dollar of premium earned on direct losses, and 67.35 cents when defense and cost containment expenses were included. The latter statistic doesn’t include other overhead such as staff adjusters or advertising.

- Sentry broke into the Top 25 with a 0.44 percent market share, displacing New Jersey Manufacturers.

- The Top 25 includes three AAA-affiliated carriers: No. 11 Auto Club Enterprises, No. 16 (down from No. 15) CSAA and No. 19 (up from 20) Auto Club of Michigan, which are technically separate companies. Were they a single company, they’d control 3.42 percent of the market, the same as 2018. This would make them No. 8, displacing Nationwide.

The market share data carries value for collision repairers.

One is a means of educating customers about the idea that their insurer might be making money off of premiums prior to reinvesting the “float” — and therefore have no grounds to seek to capture more profit by arbitrarily denying estimate line items.

The standings also offer an industrywide perspective on which insurers a shop is likely to see more or less of in 2020 — and perhaps how worried they might be about losing customers.

Direct repair program shops and shops considering joining a DRP also benefit from the perspective on how much work might be coming or not coming in from a particular carrier.

The data might also help independent repairers identify thriving smaller insurers seeking DRP partners. NuGen IT employee owner and business development executive Pete Tagliapietra in 2019 said top carriers are becoming unattainable for independents, but body shops can rack up volume by pursuing multiple second- and third-tier insurers.

“They all want it (DRPs),” Tagliapietra said last year. But the lower-share insurers can’t get priority with the big multi-shop operations, creating an opening for smaller repairers.

A little extra context on “smaller” insurers: No. 25 Sentry still did $1.1 billion in earned premiums last year. The NAIC data reports nearly $32.8 billion in earned premiums going to carriers outside of the Top 25, which altogether would constitute doing more in sales than Progressive.

In other NAIC data news, the association in January 2020 reported the average auto insurance premium rose $60.22 to $1,004.58 in 2017, the most recent data available. The average combined premium — the customer bought liability, collision and comprehensive — rose $67.85 to $1,133.92. Collision $21.17 to $363.08, liability rose by $39.44 to $611.12, and comprehensive rose $7.23 to $159.72.

More information:

National Association of Insurance Commissioners 2019 P&C market share report

NAIC, March 30, 2020

NAIC Auto Insurance Database Report 2016/2017

NAIC, January 2020

Images:

The National Association of Insurance Commissioners has reported 2019 auto insurance market share data. (sorbetto/iStock)

The private passenger auto insurance industry continued to consolidate in 2019, with the Top 10 insurers representing 71.04 percent of the market, up 0.61 percentage points from 2018, according to the National Association of Insurance Commissioners. (John Huetter/Repairer Driven News)