Allstate looking to raise rates throughout 2022; With Q1 results from Chubb, no mention of rates going up

By onInsurance

Allstate has announced it plans to raise its rates throughout 2022 because of an increase in the number of physical damage and bodily injury severity claims, while Chubb, another major U.S. auto insurance carrier, didn’t mention upcoming rate increases despite a decrease in net income when revealing its Q1 financial results earlier this week.

“Inflationary trends continue to adversely impact both current and prior report year incurred severity and loss reserve estimates,” Allstate said in an April 21 news release. “As a result, beginning with this month’s release, we are further expanding reporting transparency by disclosing quarterly non-catastrophe prior year reserve reestimates (favorable or unfavorable) in the release issued for the final month of each quarter. For the first quarter of 2022, unfavorable non-catastrophe prior year reserve reestimates totaled approximately $160 million and were primarily driven by both auto physical damage and bodily injury severity.

“Prior year reestimates reflect the impact of rapid increases in loss costs since the second quarter of 2021. We also continue to experience the impact of elevated severity inflation in the current report year, with Allstate brand report year incurred severity on property damage and bodily injury coverages estimated to increase by 11.0% and 8.0%, respectively, relative to 2021.”

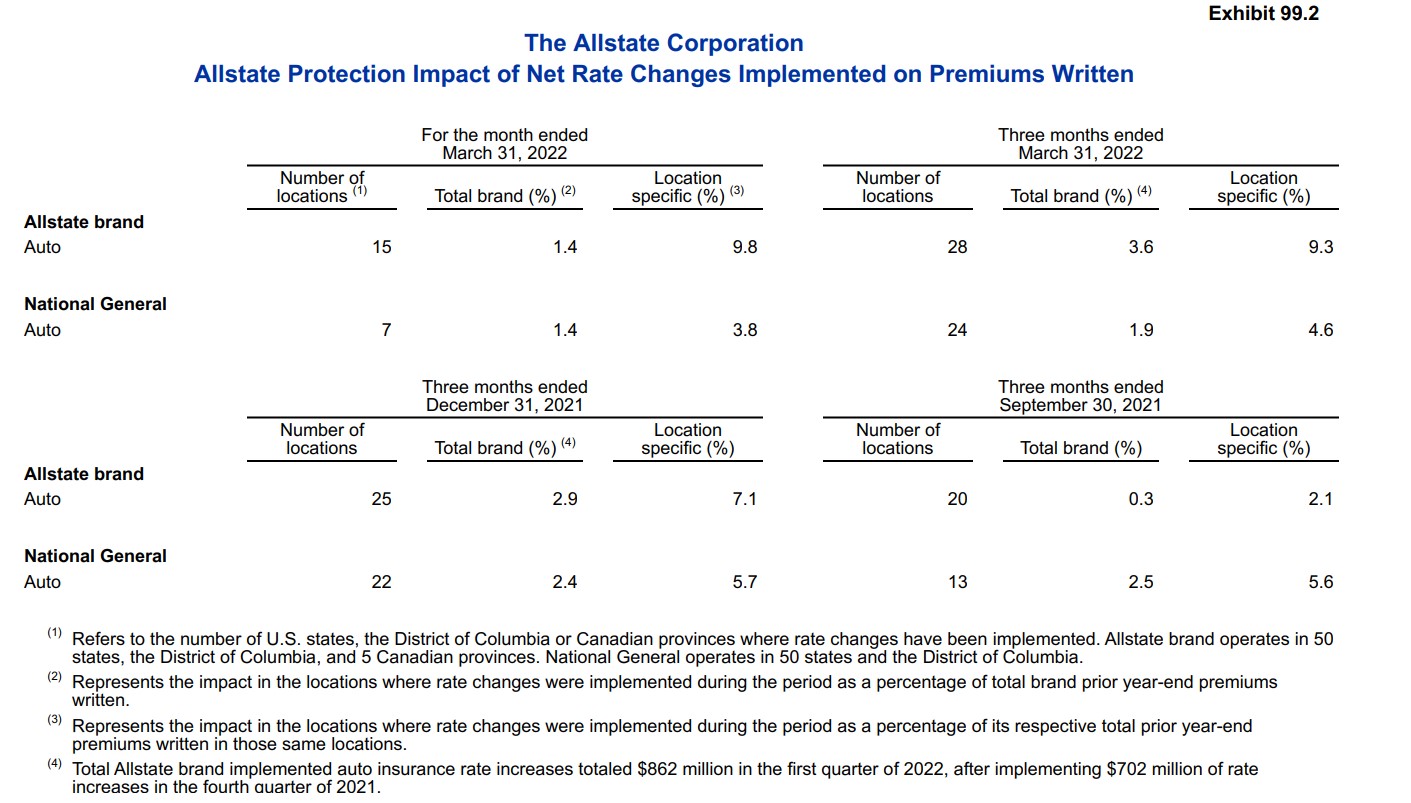

Allstate CFO Mario Rizzo said the company increased its rates in March, on average, by 9.8% in 15 locations and “implemented 53 rate increases averaging approximately 8.2% across 41 locations since the beginning of the fourth quarter 2021.”

“These locations represent approximately 62% of 2021 Allstate brand auto written premiums,” Rizzo said. “The increase to Allstate brand total auto insurance written premiums of approximately 6.5% implemented over this six-month period will be earned throughout this year and into 2023.”

In March, during a special investor conference focused on auto insurance, Glen Shapiro, Allstate’s president of personal lines, noted that under the stay-at-home orders due to the COVID-19 pandemic the company saw “strong profitability in 2020 and early ’21.” That changed, however, in the second half of 2021, “driven by inflationary pressure on severity,” he said. In February, Allstate said they’re increasing their rates as their costs rise, and that they see no reason why regulators at the state level would not approve their “justifiable and supportable” new rates.

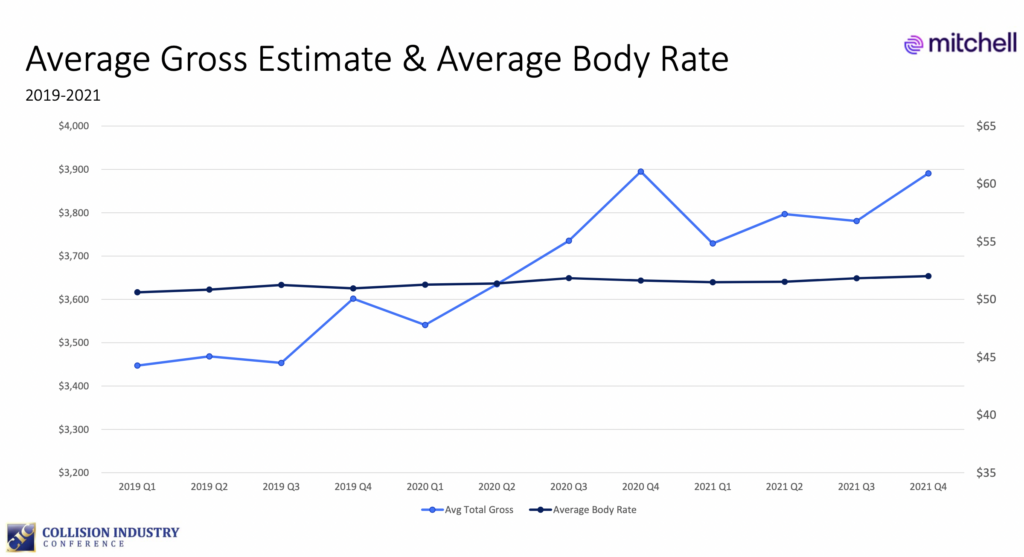

Despite Allstate’s rate increases in response to rising costs, data presented by Mitchell International during a recent Collision Industry Conference (CIC) meeting showed increased average gross estimate figures may not yet be reflecting potential shifts from the industry in terms of offsetting their own rising costs through labor rate increases.

Mitchell Performance Consulting Director Ryan Mandell told CIC attendees approval to increase premiums is “hard to come by for insurers right now.”

“When you look at the initial wake of COVID, insurers were doing pretty well,” he said. “When you have a drastic 50 to 60% reduction in claims, you’re doing OK. For a business that thrives on making 4 cents on the dollar, we had companies making 10 to 15 cents on the dollar. That’s completely turned around now and it’s going the opposite way. Insurers are losing money, primarily because of the increase in total loss settlements and the payouts. We’re seeing carriers that are facing 30 to 35% increases in the overall total loss settlements year over year. In some states, they’ve flat out told the insurance industry that there will be no rate increases that are allowed by regulators any time in the next five years.”

Boyd Group CEO Tim O’Day said last month the “unprecedented” number of rate increases the company has negotiated with a majority of insurers, and likely more to come, are necessary to address the wage pressures brought on by the continuing tight labor market and shortage of technicians as well as office workers. Boyd Group owns Gerber Collision.

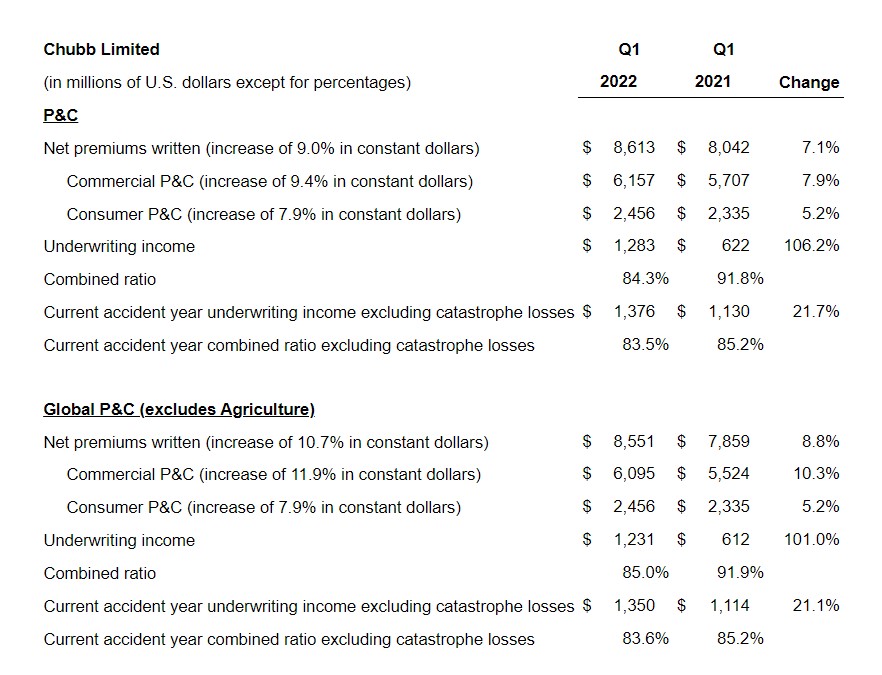

Chubb’s Q1 results show a net income of $1.97 billion, down from $2.3 billion in 2021, but its core operating income grew 43.6% to $1.64 billion, according to a news release. The Property and Casualty (P&C) combined ratio was 84.3% compared to 91.8% at the same time in 2021, and the current accident year P&C combined ratio, excluding catastrophe losses, was 83.5% compared to 85.2% last year.

“We had an excellent start to the year with record operating earnings and underwriting results, double-digit commercial premium growth accompanied by rate increases in excess of loss cost, and growing momentum in our consumer businesses globally,” said Evan G. Greenberg, Chubb chairman and CEO. “Core operating income per share of $3.82 was up 52%, P&C underwriting income more than doubled, and our P&C combined ratio was 84.3% – all records.”

A Q1 financial supplement shows that for personal auto insurance, Chubb’s consolidated net premiums were $412 million compared to $387 million at the end of Q1 2021. The company’s commercial P&C net premiums written were just under $4.04 million compared to nearly $5 million at Q4-end 2021.

S&P Global Market Intelligence found in its recent analysis that “the largest commercial auto insurers posted the lowest average combined ratio and the highest combined direct premiums written and net premiums written in 2021 in the last five years.”

Allstate and Farmers Insurance saw the highest loss ratio, and thus, the highest combined ratio at 117.3% and 127.7%, respectively, according to S&P. State Farm had the second-worst combined ratio at 118.1%

“Direct premiums written for the companies included in this analysis jumped to $53.90 billion; net premiums written increased to $46.53 billion,” the report states. “This represented a steady rise over the previous five years, from $36.11 billion for direct premiums written and $30.64 billion for net premiums written in 2017.”

S&P predicts most commercial line carriers will continue to see expense ratio improvement throughout this year and 2023, according to the report.

IMAGES

Featured image credit: ThitareeSarmkasat/iStock

Allstate Protection Impact of Net Rate Changes Implemented on Premiums Written (Provided by Allstate)

“Average Gross Estimate & Average Body Rate” (Provided by Ryan Mandell and CIC)

Chubb Limited financials graphic (Provided by Chubb)

More information

NAIC: No. 1 insurance complaint from policyholders is claims handling delays