Auto body shops reliant on CDI or own legwork for Calif. labor rate survey oversight

By onBusiness Practices | Insurance | Legal | Market Trends

The California Department of Insurance while developing its current labor rate survey regulations in 2016 removed its plan to require insurers make public the posted rates reported by every responding body shop.

Unfortunately, this action removed a convenient means for repairers and consumers to “check the work” of the insurer conducting the survey without having to involve the agency.

Make no mistake: The CDI regulations were a big win for shops and consumers. A wealth of data on survey methodology and prevailing rates is still publicly available under a simple records request to the CDI — and soon might be even easier to access online.

Tony Cignarale, CDI deputy commissioner for consumer services and market conduct, said CDI personnel “aren’t that far away” from simply posting the standard and nonstandard surveys online for everyone to download.

California repairers and consumers also have more insight into how insurers determine labor rates than their peers in many other states, and carriers are encouraged by regulators to use a format that’s more accurate and fair than the questionable surveys carriers tried in the past. The fact that the California Autobody Association supported the measure and insurers screamed bloody murder speaks volumes about the merit of the CDI’s reforms.

But regulators and shops both in California and nationwide should still be aware of how the format could be improved.

Right now, the absence of posted rates from the public record means body shops and consumers wanting to dig deeper and vet insurers’ results may have to rely upon the CDI to do so in what technically could be a “black box” process.

At first, the CDI wasn’t providing the lists of shops which had responded, eliminating a critical “Rosetta Stone” for a shop to check the insurers’ work itself. We asked the agency about the absence of this data, which the regulation declared a public record.

“For the Standardized Surveys, since the data was so large (i.e. Prevailing Rates for more than 6,000 shops), the additional data that contained the list of shops that responded to the Standardized Survey was not provided unless the member of the public requested it,” the CDI wrote in a June 27 email. “Our experience was that the two lists created confusion. However, we recently decided to change this practice and provide both lists at the onset.”

The agency in a July 2 package indeed was kind enough to provide us with a copy of updated survey data containing both the insurers’ most recent labor rate surveys and the list of responding shops. Get all of that data here.

Both concerns were illustrated in a recent complaint from a Southern California shop to the CDI. The incident ended with the shop receiving the missing information anyway, but the process also showed the potential hole in the system regarding posted rates.

Shop complaint

Jennifer Yeung, office manager and estimator for European Motor Car Works, had complained to the CDI in March about the public record Ameriprise filed associating a $52 body labor rate with the luxury repair facility. The shop’s hourly body charge reported to Ameriprise in a labor rate survey was more than $10 higher.

An Ameriprise adjuster had refused to budge off the $52 rate in a claim involving a Land Rover, citing a survey conducted under the CDI’s own Standard template which produced that amount.

California regulations allow the insurer to pay a prevailing rate determined by a survey of local shops rather than a specific repairer’s posted rate.

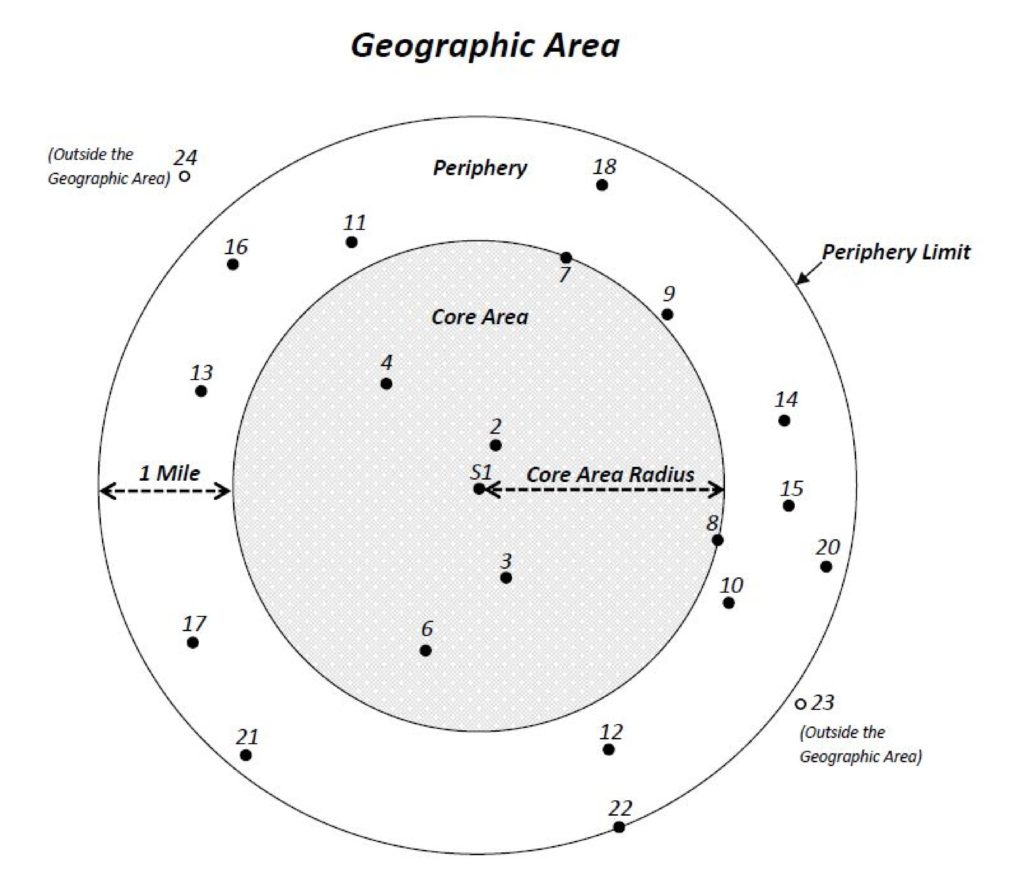

The CDI established a suggested standard format in the 2016 regulation overhaul. That template defines a market as every responding shop in a region extending a mile out from a six-shop cluster of survey respondents closest to or including the shop whose rates are being compared to the market (assuming the shop completed the survey).

If an insurer follows the CDI template, they receive a “rebuttable presumption” of good faith, and other carriers besides Ameriprise have indeed opted for that route. Insurers can still use any survey format they want, but the lack of automatic good-faith presumption puts the alternative format at greater risk of being declared an unfair claims settlement practice. Carriers also are free to forego a survey, though they’d presumably have to accept a shop’s labor rate given a lack of evidence of its relationship to the market.

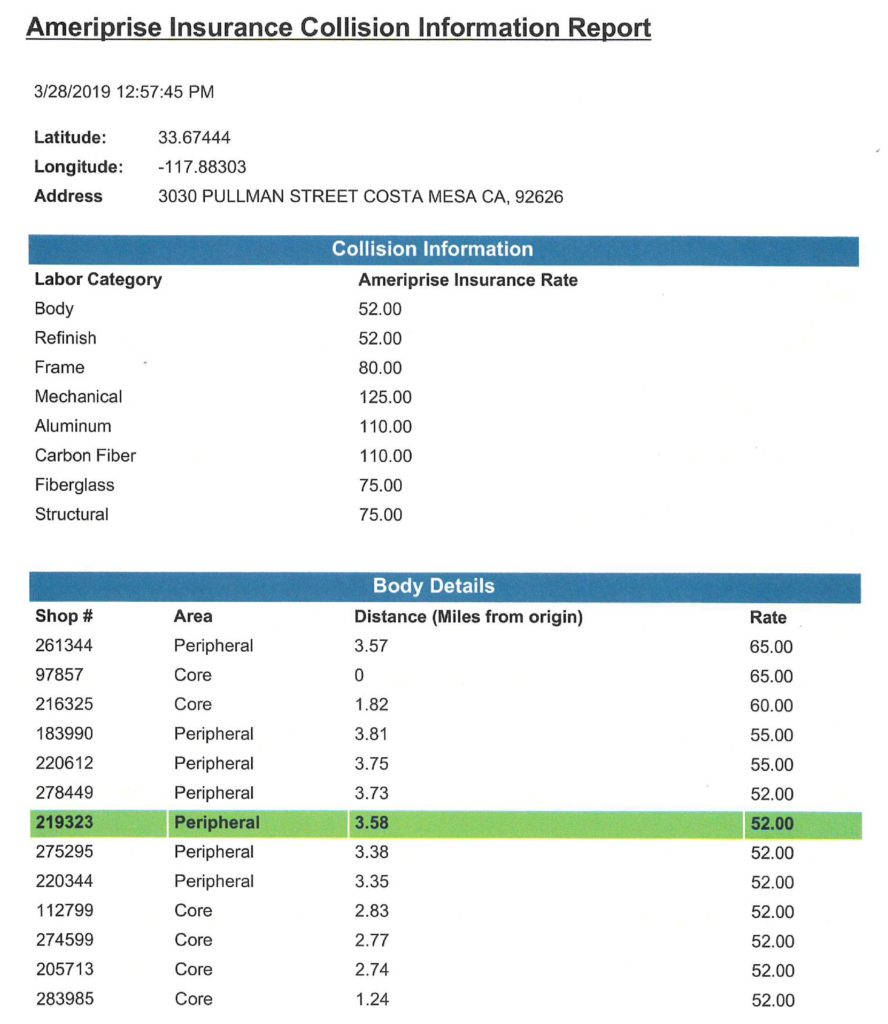

Ameriprise replied to Yeung on April 23 and referenced having provided a copy of survey results from the six core shops and seven peripheral shops used to calculate the $52 rate for European Motor Car Works.

However, Yeung said Ameriprise never actually sent that document. She contacted the carrier and got no response. CDI associate insurance compliance officer Abraham Rivero sent her a letter dated April 26 declaring it had found no wrongdoing.

As she hadn’t received the data from Ameriprise, Yeung asked Rivero for more information, asking how he knew the rates were accurate. “He could not tell me how he verified” the data, she said.

Yeung said she asked Ribero to show her the results of the survey, and he refused during a May 1 phone call. He said Ameriprise used a formula found on CDI’s website, but when Yeung asked for its location, Rivero “wouldn’t tell me where it was at,” she said.

She wrote in an email to Repairer Driven News on May 3 that when “I asked him to direct me where to find it, he wouldn’t, and then told me ‘since you know so much I’m sure you can find it in the law and figure it out.'”

Yeung finally got the missing data from Ameriprise following our May 6 inquiry to the CDI about her allegations. The CDI sent her Ameriprise’s response and the missing list of shops the insurer used to calculate the rate, identified only by what appeared to be their Bureau of Automotive Repair license number.

CDI also replied to our inquiry directly:

The California Department of Insurance (CDI) does not discuss specific inquiries from members of the public. However, CDI disagrees with the allegations being made by this collision repair shop. It appears that this shop owner has a misunderstanding of the Standardized Labor Rate Survey Regulations and how a “prevailing rate” is determined according to these regulations. In addition, with regard to the suggestion that CDI refused to provide the shop with the calculation used to determine the shop’s prevailing rate, we would disagree with that assertion. In fact, the insurance company provided the shop with a detailed breakdown of how it calculated its prevailing rates. CDI has sent the shop owner a letter clarifying the law and how it applied to this shop’s claims. CDI takes allegations of unprofessional conduct seriously, but has not found any evidence that such behavior occurred in this instance. If you wish further information on this case, we suggest you contact the shop directly.

If Yeung hadn’t followed up with the CDI, it seems she’d have been left without Ameriprise’s data supporting its determination of her prevailing rate. And even then, how would European Motor Car Works know those rates are correct, Yeung argued.

Technically, Ameriprise didn’t even have to oblige her with European Motor Car Works’ own market-specific list. We spoke to Cignarale about the regulations in general (not Yeung’s specific case). He said the current labor rate survey regulations do not require an insurer to provide a repairer with the list of shops used to calculate the shop-specific prevailing rate.

The actual rates they report is deemed non-public information; an insurer can provide it to a shop if they wish, but only the CDI by law must receive it.

If Ameriprise didn’t give her such a list, Yeung could have checked the carrier and CDI’s calculation by reverse-engineering which competitors were factored into her market rate — that is, had she been able to ascertain which shops actually responded to the study.

As discussed above, that information is now available to shops, but it wasn’t provided at the time.

The updated results the CDI shared last week show that only 1,496 out of the 6,409 shops assigned prevailing rates responded to the Ameriprise survey.

If the insurer won’t provide the actual posted rates in a dispute over what the carrier calls the prevailing rate, a collision repairer (or consumer) has two options.

Armed with the list of responding facilities, a shop could do the legwork to confirm which rates the nearest 5-6 shops are said to have reported, such as calling a competitor and inquiring as to their door rates for various labor categories. A shop would then be able to perform the same prevailing rate calculation as the insurer and see if the answer matches. However, this still might make shops uncomfortable on antitrust grounds and take up a small business’ valuable time.

The other alternative would involve the shop or consumer filing a complaint with the CDI and trusting the agency to scrutinize the labor rates reported and/or request the insurer release the information. This extends the claim resolution process for the length of the investigation and takes up the agency’s time and taxpayers’ dollars.

Ironically, the CDI was all set to make the “labor rate reported by each shop that responded to the survey” and name, address and license number of every responding DRP shop publicly available, based on its initial March 4, 2016, draft of the regulation.

“Subdivision (7) is proposed to be adopted in order to clarify that the insurer must include in its submission to the Department the labor rate reported by each shop that responded to the survey,” the CDI wrote in its initial statement of reasons. “This information is currently included in most or all surveys currently submitted to the Department under this Insurance Codes section 758(c). Since a primary purpose of these surveys is to make them available to the public, not including this information conflicts with this important purpose, and is reasonably necessary for clarity purposes. …”

The CDI explained the disclosure of DRP status by arguing, “Since a primary purpose of these surveys is to make them available to the public, not including this information conflicts with this important purpose. Additionally, the proposed subdivision is reasonably necessary for consistency with CCR sections 2695.81(d)(6) and 2695.82.”

But by October 2016, it had dropped both plans.

In a circular explanation, the CDI said at the time that it decided to make a shop’s DRP status “non-public” because it was “non-public.” (Which is ironic because one function of a DRP is for the insurer to promote those shops to the public.) The agency gave no other explanation.

“This subdivision, which was previously subdivision (d)(8), was moved from ‘public information’ to ‘non-public information’ to address the issue that information about an insurers’ Direct Repair Program is considered ‘non-public’ information rather than ‘public information,'” the CDI wrote. “Further the subdivision requires the name, physical address of record, and license number with the BAR be reported to the Department. The Department felt it was necessary to move this from public to non-public information that must be reported given that information as to whether or not a shop is a specific member of an insurer’s Direct Repair Program is non-public information. Thus, the renumbering of the subdivision as non-public is reasonably necessary to account for this fact.”

The CDI described the decision to eliminate rate transparency as throwing a bone to the insurers it was trying to rein in.

“The Department felt it was necessary to move this from public to non-public information that must be reported to the Department given that the labor rates reported by each shop that responded to the survey is non-public information, rather than public information,” the CDI wrote in October 2016. “Insurers invest time and resources into their labor rate surveys, and the responses they receive from shops regarding labor rates for each shop is nonpublic. Thus, the renumbering of the subdivision as non-public is reasonably necessary to account for this fact.”

It also in October said commentators were afraid shops would collude on pricing.

“I ask you to re-consider softening or giving Insurers any more latitude to manipulate claimants than they currently do now,” Eric Dash of Pennsylvania-based Black Walnut Body Works wrote Sept. 28, 2016.

“Auto repairer trade press reporting on the proposed regulations included discussion about how the amended regulations noticed in the 15 Day Notice removed the requirement for labor rates contained in survey responses to be made public,” the CDI wrote back. “This requirement, which was never in statute or regulation, was removed in response to commenters who were concerned that posting of the rates from all responding shops might lead to collusive behavior by the auto repair shops. The proposed regulation still requires that the labor rate for each geographic area be made public. The Department believes that Commenter may be referring to the removal of this requirement when stating that the proposed regulation would weaken consumer protections. However, this shop-specific labor rate is required, per these proposed regulations, to be made available to the Department in order for the Department to carry out its regulatory functions.”

This ignores the fact that price-fixing is illegal. It’s the equivalent of banning all hammers because a murderer might use the tool to kill someone someday.

Nathan Simmons of CMC Collision also cast doubt on this collusion fear in April 21, 2016, comments to the CDI:

“Lastly, I guess, that there’s another side to this coin that there will ultimately need to be mechanisms in place to prevent the trade – the trade associations from taking advantage of the insurers,” Simmons said. “And that, you know, theorize that, We’re going to have – you know, We’re going to end up with rates $500 per hour because the Department’s leaving it up to us to dictate what our rates are going to be. Eventually, and little by little by little the rates are going to keep climbing and climbing and climbing and it’s going to get to a point where it’s not fair for them.

“And I think my response to that is, just like we’re here today, trying to figure something that’s not fair to us, the body shops, they’re more than welcome ten years down the road from now when it becomes unfair, if it does, to petition and lobby to the Department of Insurance to figure out a solution at that time.

“It’s all a theoretical problem. It doesn’t currently exist and I don’t think we need to waste a whole bunch of time trying to prevent shops from overinflating their rates in hopes of getting a raise. I think there’s simple mechanisms that you guys could probably come up with to prevent that. And I don’t think we should put a kibosh on this whole thing because of the theory, This is going to get out of control.

“I think insurers are heavily regulated but that’s because they were out of control. And so, when we’re out of control, then you can regulate us. We’ve yet to ever be out of control. So let’s cross that bridge when we get it to, I would say.”

David McClune of the California Autobody Association while supporting the regulation also opposed the excision of labor rates from public information.

“The CAA requests that the Department reconsider the proposed deletion … from the original text which require insurers to make public the labor rate reported by each shop that responded to the survey,” McClune wrote Oct. 10, 2016. “We believe this section is very important and increases transparency by providing those seeking information to have easy access to the labor rates relied upon by insurers to determine a prevailing auto body rate in a specific geographical. Moreover, without this section there is more room for possible abuse by insurers.”

“The requirement that insurers make public the labor rate of each responding shop was deleted due to the concern of other commenters that making such information public would tend to lead to collusion among auto repairers and cause increased repair rates,” the CDI replied. “Although the labor rate of each responding shop will not be public under the proposed regulations, the prevailing rate for each individual shop will be public information. The Department believes that making the prevailing rate public provides sufficient transparency for an individual shop to determine whether they are being paid at the appropriate rate by an insurer. However, this shop-specific labor rate is required, per these proposed regulations, to be made available to the Department in order for the Department to carry out its regulatory functions.”

As noted above, this calls for shops to put their trust largely in the CDI — whose receptiveness to repairers could change after an election — and hope no breakdowns occur in the system.

“The other problem we encounter is that when an insurance adjuster tells us how much they are going to pay per hour, we ask them to show us their survey and they can never provide you with a copy,” Isela Bowles, Formula 1 Collision Center wrote April 22, 2016. “Furthermore, the two times that I have submitted a public records request for these surveys there was never a response. That leaves us without a way to confirm that these unfair labor rate are true and we are not able to verify that these labor rate surveys even exist.”

“The proposed regulations address this transparency issue as the Commenter mentions,” the CDI wrote. “The proposed regulations may require that the public survey data submitted to the Department is in electronic format so that it can easily be published on the Department’s website. Labor Rate surveys can still be requested through a Public Records Act request under the proposed regulations. The Department strives to comply with every Public Records Act request, and is unaware of any specific instances where the Department has failed to provide a labor rate survey as requested under a Public Records Act request. However, posting survey results on the web may eliminate some of the need to do a public records request.”

Bowles also in April said she had a concern about “accessibility to the actual so called labor rate surveys” — calling it “most important.”

“Businesses have a disadvantage and lack of accessibility,” she wrote.

“a) We are not provided with a copy of surveys.

“b) We have to do a public records request for a copy of surveys

“I personally have requested these records twice and have never received a response, therefore I was never given the opportunity to see, inspect, nor verify these surveys.” (Minor formatting edits.)

“The proposed regulations address the accessibility issue that the Commenter mentions,” the CDI wrote. “The proposed regulations may require that the public survey data submitted to the Department is in electronic format so that it can easily be published on the Department’s website.

“Labor Rate surveys can still be requested through a Public Records Act request under the proposed regulations. The Department strives to comply with every Public Records Act request, and is unaware of any specific instances where the Department has failed to provide a labor rate survey as requested under a Public Records Act request. However, posting survey results on the web may eliminate some of the need to do a public records request.”

Despite getting a break on making reported rates public, the Insurance Industry Coalition still complained about the reporting requirements in Oct. 11, 2016, comments.

“We also feel that the reporting requirements under this section are particularly onerous, unnecessarily cumbersome, with no justifiable necessity,” the coalition wrote. “This section will require the preparation of two different reports one public and one private for information that goes far beyond the authority authorized in 758(c). We do not view this section as necessary for the Department to perform any task that they are authorized to perform. The revisions to the reporting rule will only create more work for insurers, especially the need to report the names of auto body repair shops who responded and those who do not, with no obvious benefit to consumers. This clearly fails to compile with the necessity test.”

“Commenters comment is inapplicable to the proposed regulation, as reporting of labor rate survey results is already required by statute,” the CDI replied. “The regulations specify physical address, as opposed to address, adding clarity to the statutory language and specificity that is necessary to determine where the shop is located. They also provide additional information relating to the standardized survey and add a date the survey was completed so that the Department can ensure old surveys are not being used to settle claims.

“The information reporting requirements of the proposed regulation impose a burden no more onerous than current statutory reporting requirements and are reasonably necessary to allow the Department to determine whether the survey was done in accordance with the parameters of the standardized survey methodology. The Department notes that the ‘requirement’ for a public and private report was added at the request of Commenters, who alleged that making the rates of responding shops public would lead to collusion. In response to Commenters’ overamplified concerns about collusion, the Department amended the reporting requirement such that survey rates would be private information and the prevailing rate for each shop would be public; both data points are necessary for the Department to determine whether the survey was done correctly.”

“Commenters’ complaints about the ‘onerous’ reporting requirements conveniently overlook the fact that no insurer is required to complete a standardized labor rate survey; insurers correctly completing the survey receive the benefit of the rebuttable presumption. Names of shops are required of any survey to verify that the data reported is correct.” (Emphasis ours.)

More information:

Labor rate surveys made public by CDI in June 2019

California Department of Insurance, June 2019

CDI initial statement of reasons for labor rate survey regulations

CDI, March 4, 2016

CDI final statement of reasons and response to comments on labor rate survey regulations

CDI, Oct. 14, 2019

CDI labor rate survey regulation

Images:

California Department of Insurance labor rate survey regulations suggest a market be the nearest six shops who respond to the survey plus every respondent in a circle extending out a mile from the furthest shop. (Provided by CDI)

Ameriprise in a spreadsheet dated July 2018 calculated the prevailing rate for European Motor Car Works using it and 12 other facilities within a less than 4-mile radius. (Provided by California Department of Insurance)

Costa Mesa, Calif.-based European Motor Car Works is shown. (Provided by European Motor Car Works)

Democratic California Insurance Commissioner Dave Jones speaks Aug. 12, 2016, at NACE. (John Huetter/Repairer Driven News)