Special commission supports legislative solutions to Massachusetts’ stagnant labor rates

By onInsurance | Legal

Declaring that the state’s auto body labor rates “must be addressed” after more than three decades of inaction by auto insurers, a Massachusetts commission has recommended a number of potential solutions, including several pending bills that would regulate reimbursed rates.

The recommendations are contained in the final report of the Special Commission on Auto Body Labor Rates, the product of four months of work. The report was adopted by a 10-3 vote, with the panel’s three insurance industry representatives all giving it an unfavorable recommendation.

Most of the recommendations included would legislate mechanisms for adjusting the labor reimbursement rate, which, at $40, is the lowest in the U.S. The rate is currently unregulated.

The report now goes to the legislature’s Joint Committee on Financial Services and the House and Senate committees on Ways and Means.

Missing from the report are any recommendations from the state’s auto insurance industry, a point highlighted by the Alliance of Automotive Service Providers of Massachusetts (AASP-MA).

“For decades the insurance industry has shown an inability to even acknowledge the issue, nor change their business practices,” AASP-MA said in its section of the report. During two public hearings, “they offered no viable alternatives or solutions to suggest that anything other than a mandate would change the business environment. That mandate must be that insurers compensate fairly and properly for the increased cost to repair today’s vehicles.

“The consumers in Massachusetts deserve to be protected on our roadways. They should also feel confident that their chosen collision repair facility is able to maintain staff, training and equipment requirements, because they would then be adequately reimbursed for the expertise, costs and the liability involved in the collision repair process,” AASP-MA said.

Legislators gave the commission a number of tasks, including a determination of whether the current labor rates are reasonable, and, if not an evaluation of possible solutions.

Legislators gave the commission a number of tasks, including a determination of whether the current labor rates are reasonable, and, if not an evaluation of possible solutions.

“The Commission recognizes that auto body labor rates must be addressed and that the auto body labor rate has not increased significantly since 1988,” the report states. “After conducting numerous public meetings and hearings, there are a multitude of options available to address the issue highlighted in this report.”

Varied options

Two of the “possible options and solutions” included involve pending legislation:

- Adoption of one of four bills – HB 1048, HB 1152, HB 1178, and SB 711 – that would create a legislated labor rate that insurers would be required to pay. The rate would be set based on the average labor rate of surrounding states.

- Adoption of one of two bills – HB 1111 and SB 709 – that would adjust the labor rate for 20 years of inflation, and index future changes to the region’s Consumer Price Index.

The commission also recommended the establishment of a permanent Labor Rate Advisory Board, which would address “any and all issues” related to labor rates, and conduct an annual labor rate survey to be used in determining a “fair and equitable labor rate.”

The commission would include the insurance commissioner, the attorney general, representatives of the auto repair industry, insurers, vocational schools, new car dealerships, consumer advocate groups, and an economist.

The board would also collect relative industry data, such as rates paid in neighboring states, workforce data, vocational school trends, and insurance premiums. “In order to provide a long-term solution, the results of the survey and the collection of said data shall be reviewed and analyzed by the advisory board annually. This data should be used as factors to provide a basis and recommendation for which the board can discuss a fair and equitable labor rate,” the report says.

Also included are the recommendations of the AASP-MA and the Massachusetts State Automobile Dealers Association (MSADA).

The AASP-MA recommends three approaches to raising rates. The first is an immediate increase of $33 in the current $40 labor rate, with yearly adjustments based on the region’s Consumer Price Index (CPI). The second is the passage of HB 1111 as proposed. The third is passage of HB 1111, with an adjustment in the rate correction period, and a schedule of rate increases that includes an immediate rise of $18 an hour, an increase of $10 in year two, and continued increases based on the region’s CPI.

“The tiered roll out addresses the immediate need for an increase to bring technicians back into the industry, while making the industry more appealing to younger individuals in the vocational schools,” AASP-MA said. “It also allows the insurance industry a corrective period and the ability to calculate reimbursement their premium needs during the transition to a fair and equitable reimbursement rate.”

MSADA recommended legislation that would give the state’s insurance commissioner authority to set minimum rates, with those rates based on shops’ receipts for non-insurance work paid for by customers. Testifying before the commission during a March 22 public hearing, Sam Valenzuela of LaborRateHero noted data showing that a great majority of consumers are willing to pay $50 or more.

“The free market in Massachusetts absolutely would accept these higher rates that are necessary for shops to have a sustainably profitable business and all the things that go along with that,” Valenzuela testified.

Although the status quo, rate setting based on negotiations between body shops and insurers, was listed among the “possible options,” the commission noted that “This is not a viable recommendation and will not provide a long-term solution to the issue of auto body labor rates.”

James M. Murphy (D-4th Norfolk), one of the commission’s co-chairs, had encouraged all engaged parties to submit their own recommendations. Yet the report includes no response from the insurance industry.

Voting in favor of the report were state representatives Murphy and Steven S. Howitt (R-4th Bristol), state senators Paul R. Feeney (D-Bristol and Norfolk) and Ryan C. Fattman (R-Worcester and Norfolk), Michael D. Powers of the Massachusetts Division of Insurance, vocational school representative Kenneth Stukonis of Assabet Valley Regional Technical High School; Evangelos “Lucky” Papageorg, executive director of the AASP-MA; body shop representatives Ray Belsito of Arnie’s Auto Body and William Lamborghini of Total Care Accident Repair Service, and dealership representative William DeLuca of the DeLuca Family of Dealerships.

Voting against were Samantha Tracy of Arbella Insurance Group, Michael Nastari of MAPFRE, and Paul Segota of Safety Insurance Company.

No vote was recorded for Rebecca Dutra, representing the state attorney general’s office.

Repairer Driven News on Monday attempted to reach Tracy, Nastari, and Segota for comment. None had responded as of our publication deadline.

Public hearing testimony

During the Jan. 25 and March 22 public hearings, dozens of auto body professionals and vocational teachers testified about the harm that the stagnant labor rate has done to the industry, which has absorbed decades of rising costs. Repairers noted that the low reimbursement rate makes it difficult to attract new technicians to the industry when they can make more per hour in many other related fields.

The commission’s report notes that the average collision repair salary in Massachusetts is $47,400, while the annual mean wage for all industries, according to the Bureau of Labor Statistics, is $72,940.

The only presentation on behalf of the insurance industry was made on Jan. 25 by Christopher Stark, the executive director of the Massachusetts Insurance Federation.

Stark told the commission that the auto body labor rate paid by insurers in Massachusetts has not risen in 30 years because of “market forces,” rather than rate suppression by insurers.

Stark told commission members that increased competition has led some body shops to enter into direct repair program contracts with insurance companies and that the lower labor rates that are part of those contracts figure into the industry’s determination of the prevailing labor rate.

Among the report’s appendices is a report from a similar commission, compiled in 2008. That report’s findings were never followed.

The 2022 report also includes information about the change in the number of auto body shops in the state since 2008. It found that there were 1,686 shops in the state as of 2022, a decrease of 119.

More information

Dec. 15 virtual public meeting

Jan. 25 virtual hearing

https://malegislature.gov/Events/Hearings/Detail/4167

March 22 virtual hearing

https://malegislature.gov/Events/Hearings/Detail/4230

April 4 site visit and virtual public meeting

https://malegislature.gov/Events/Hearings/Detail/4255

Written testimony to the commission

https://malegislature.gov/Events/Hearings/Detail/4167

https://malegislature.gov/Events/Hearings/Detail/4230

Insurers’ auto body labor rates well below ‘market rates,’ expert tells Mass. commission

Mass. special commission holds 4-hour hearing on body shop labor rates

Insurance industry rep. blames ‘market forces’ for stagnant auto body labor rates in Mass.

AASP-MA meets with lawmakers on inflation-tied auto body labor rate bill

Images

State Rep. James Murphy, right, co-chairman of the Special Commission on Auto Body Labor Rates, calls the Jan. 25 public hearing to order. (Screen capture via the Massachusetts Legislature’s website)

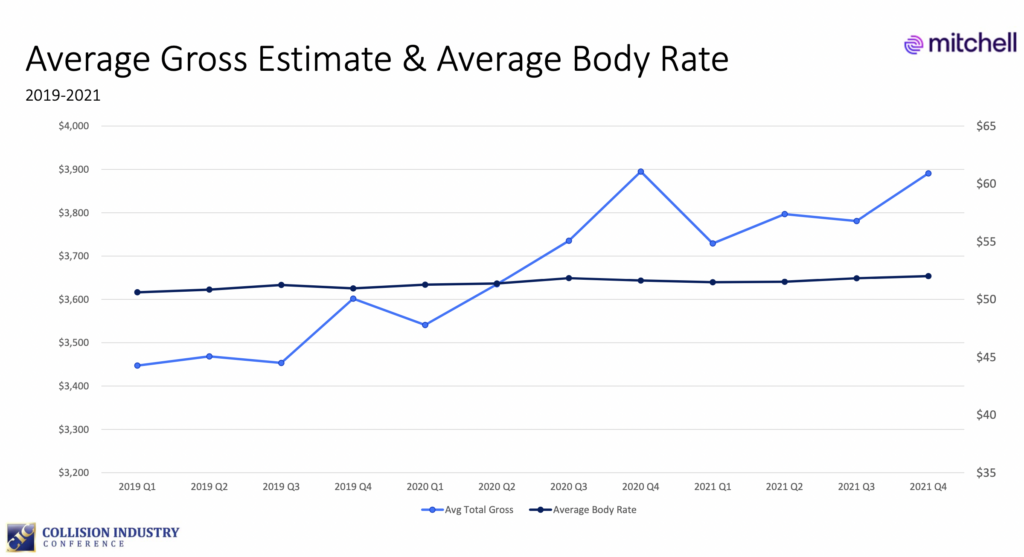

A graph, based on data supplied by Mitchell, shows that while the total gross cost of repair has been increasing since the first quarter of 2019, labor rate reimbursements have remained flat. (Provided by the Collision Industry Conference)